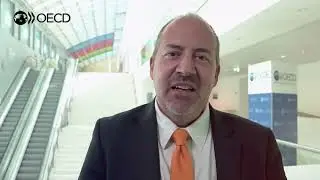

Tax evasion: Improving financial transparency with country-by-country reporting

Globalisation has benefited businesses but has also created opportunities for large multinational enterprises to shift profits and report them in low tax jurisdictions to greatly reduce their tax bill. This practice is hard for individual countries to audit, yet it erodes the tax bases which they rely on to pay for public services like roads, hospitals and schools. Country by Country Reporting (CBCR) can improve financial transparency, and bolster the OECD/G20 Base Erosion and Profit Shifting (BEPS) project by providing governments with solutions for closing the gaps in existing international tax rules that allow corporate profits to “disappear” or be artificially shifted to low or no-tax jurisdictions, even if none of their business activity takes place there.

For more information, visit: http://www.oecd.org/tax/beps/

and https://www1.oecd.org/tax/transfer-pr...

OECD Podcast: Tax in a digital world: Why new international rules matter for everyone, with Grace Perez-Navarro, / digital-tax-podcast-with-grace-perez-navarro

Follow us on social media: https://www.oecd.org/social-media

Edited: 19/02/2021